Freshbooks is more limited with its features than Quickbooks but also is available at a lower price. If you’re not sure, take this quiz to find out which option best fits your needs. For example, your internet bill is an operating expense, it directly relates to the function of your business. You need the internet to research products, to communicate with suppliers, to login to your seller central account, to run your PPC campaigns, to optimize your listings, and so much more.

If you choose to hire an accountant, you will spend anywhere from $1,000 to $5,000+ per year, not including the cost of software (which they will need). However, if you truly want to grow your business and wealth, and you have the budget, an accountant is the right move for you. Michael is the CEO and co-founder of taxomate, one of the leading eCommerce accounting integration software solutions. Taxes are another major area that sellers either forget about or like to hold off as long as possible. Failing to understand the basics of taxes can do some major damage to your business though. Did you borrow money or hired products, equipment, and other business essentials?

Your accountant can explain things you do not understand and give you valuable tips on how to handle your finances. Non-accurate books can also have serious consequences for you and your business. Your accountant will always keep you up to date and thus ensure that you remain compliant. Besides providing tax advice, most accounting firms will also take care of the tax registration for you. Especially when you start a new business or expand to another country, it can be difficult to understand the (new) tax environment.

Best Accounting and Bookkeeping Software for A Hair Salon in 2023

Our first payment was $3,300 sent to Hubei Jianguo Cosmetics Co., Ltd. on January 23. In other words, it’s the cost you spend so that you can sell whatever it is that you sell. Avoiding mixing your finances is of particular importance if your business is a sole proprietorship. For a sole proprietorship, all of the business profits, losses, and liabilities are tied personally to you and your finances.

- This report shows how changes in balance sheet accounts and income affect cash and cash equivalents, breaking the analysis down to operating, investing, and financing activities.

- I also keep separate folders for COGS and different operating expenses.

- And we know our numbers because we know accounting and bookkeeping.

- It is the amount of money that your business retains after all expenses are paid.

- Keeping accurate bookkeeping records will make tax season a lot more manageable for your accountant.

It is easy to become bogged down in your personal costs and lose track of your company activities. An organization audit will need the disclosure of complete and correct financial data. For eCommerce sellers, estimating the cost of goods sold takes a lot of time and procedure. You must include all expenditures involved in creating or purchasing the things you have sold. South Dakota v. Wayfair changed ecommerce forever by allowing states to impose sales tax on companies selling to their residents. Businesses that don’t comply, even unknowingly, are subject to hefty fines and other penalties.

The team aims to set your books up right from the outset so that they are powered by proven processes and can easily be built upon. With dedicated daily accountant answers, Osome claim to be cheaper than an in-house accountant but better service than an outsourced CPA. A great solution that meets this tension somewhere in the middle is a done-for-you software & service combination. The reality is far from that though as you are legally required to account for gross sales figures and any expenses. By simply lodging the disbursement amount as sales you are recording incorrect numbers.

And if you don’t have a lot of accounting background, this cloud-based financial management tool is easy to learn and use. We are a technology company providing automated end-to-end accounting service to ecommerce businesses. Our system connects to your apps, syncs all your data and reconciles your books in real-time, replacing your bookkeeper.

#7: GoDaddy Online Bookkeeping

Subscription-based models range – again, depending on your needs and company size – from $75/month up to $1.000/month or more. In addition, the scope of the services also differs from one service provider to another. Laws and regulations are constantly changing, especially when it comes to taxes and corporate payment obligations. Obviously, this requires them to have excellent time management and organizational skills. Of course, he also knows the tax system inside and out, so they can give you the best advice on how to save on taxes.

- Bookkeeping helps you track where your money comes from and where it’s going, but to keep your books organized, you’ll need to record transactions by category.

- Automated accounting solutions often include security features that protect your financial data from unauthorised access.

- We are a technology company providing automated end-to-end accounting service to ecommerce businesses.

- Wave Accounting is the best option for you if you’re a small business owner seeking free software.

After all, it is also your accountant’s job to educate you and to convey his knowledge in a comprehensible way. When you work with an accountant, you should be open about your expectations regarding the collaboration from the very beginning. No service provider can evaluate themselves or fake their reviews. For example, the person that leaves a review needs to provide proof that collaboration actually took place. Sellers can leave reviews for the service providers they have worked with. The one-page listings on Sermondo have the enormous advantage that, compared to a conventional website, they show the most important information about the service provider at a glance.

While spreadsheets and paper systems are a free and easy way to get started, they are really only effective for managing small volumes of data. Registering your company can protect you from certain liabilities if things go wrong, and allows you to separate your business from personal income. As the business owner, you are wholly responsible for your legal and tax obligations. For this reason, it’s tempting to put off registering a company and paying taxes in the early days.

A2X will automatically update your COGS and inventory information. Ask yourself if you have enough time to do the work that a bookkeeper could support you on. Your company’s potential savings are not always worth the time spent on gathering tips and information on financials. For businesses in the United States, the IRS can charge you fines, garnish your wages, take your assets, and send you to jail for significant offenses. If you want to plan better for the future, the cash flow forecast is an effective way. Your balance sheet will give you an elevated view of your business.

Key financial metrics to know

Remember, organization is the key to a fast, clean bookkeeping process every month. A well-organized chart of accounts helps you categorize expenses, income, and assets, making your financial journey smooth and hassle-free. Utilize the financial reports provided by your accountant and bookkeeper to set up the future for the business.

Armed with this knowledge, you can steer your ship towards success with confidence. To categorize inventory properly and keep a real-time balance sheet, you can then make decisions from data instead of just your gut feeling. The P&L report will let you efficiently see all revenue and expenses during a given period. One of the significant challenges that many new FBA operators face is understanding that profit is not cash.

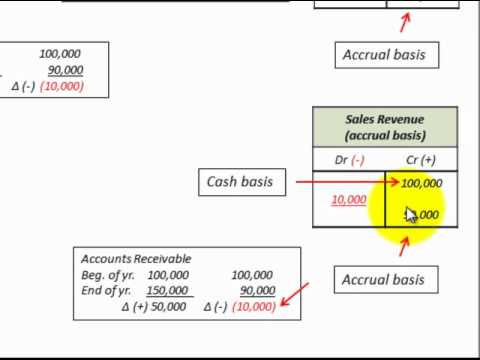

Cash vs Accrual Accounting: Speaking The Language of Business

They can automatically file your returns for you in nearly all states where you owe sales tax. With Bench.co, you work with real humans, get perfect books, and get to save yourself from hours of stressful accounting work. It doesn’t make sense to advertise a product that doesn’t have a high return.

Purchases are an integral part of working out the Costs of Goods Sold, and you subtract purchases from sales to determine overall profit. Nobody cares more about how much money is going in and out of your business than you—well, you and the IRS. Bookkeeping is a simple way to keep tabs on your money in a way that keeps both parties happy. You should also have an ending inventory balance for each month. When you purchase inventory, the amount of inventory you purchased should be added to your inventory balance. Then, each month you subtract your COGS from your inventory to get a new inventory balance.

Steersman Business Suite

By automating the process of recording transactions, automated accounting solutions can save you a significant amount of time. Buyers will be looking for accrual basis accounting in order to be able to accurately measure key performance indicators in your company’s profit and loss statement. While this can be Amazon seller accounting done after the fact, having it already broken out saves the time and gives you a month to month view of how much your business might sell for if you put it on the market. In order to assess earnings after the goods have been sold, the product’s cost is subtracted from its value and added to sales revenue.

Regularly reconcile your accounts, review your financial statements, and ensure everything is in shipshape. It’s like having a personal assistant that keeps your financial records in tip-top shape. Creating a process for regular bookkeeping will also allow you to do more traditional cash flow forecasting. Enabling you to invest in and forecast for pay-per-click (PPC) advertisements, purchasing inventory, hiring, and more through creating a worst, moderate, and best-case scenario. One of the most effective business decisions you can make today is to save the time you are spending on FBA accounting and spend it on growing the business.